Our Comprehensive Services

Expert solutions tailored for your financial needs

Taxation Expertise

Navigating complexities with confidence

2025年4月22日2025年4月22日2025年4月22日2025年4月22日2025年4月22日2025年4月22日Financial Statement Excellence

Precision in every detail

Detailed Income Statements

Our team prepares comprehensive income statements that reflect your business's performance over a specific period. These statements provide insights into your revenues, expenses, and overall profitability. We ensure accuracy and clarity, enabling you to make informed decisions based on your financial health.

Statement of Financial Position (Balance Sheet) Preparation

Understanding your business's financial position is crucial for strategic planning. We meticulously prepare balance sheets that summarize your assets, liabilities, and equity. Our analysis not only helps in assessing your liquidity but also in making informed investment and financing decisions.

Cash Flow Statements

Cash flow is the lifeblood of any business, and our cash flow statements provide a clear view of your inflows and outflows. We offer detailed insights into your operational, investing, and financing activities, helping you manage your cash effectively and plan for future needs.Strategic Advisory Services

Empowering your business for success

Investment Analysis & Business Valuations for Strategic Decision-Making

Helping investors and entrepreneurs make informed decisions through in-depth business valuations, equity research, and investment due diligence. At Panda Consulting, we specialize in building financial models, analysing market opportunities, and delivering actionable insights that support long-term value creation..

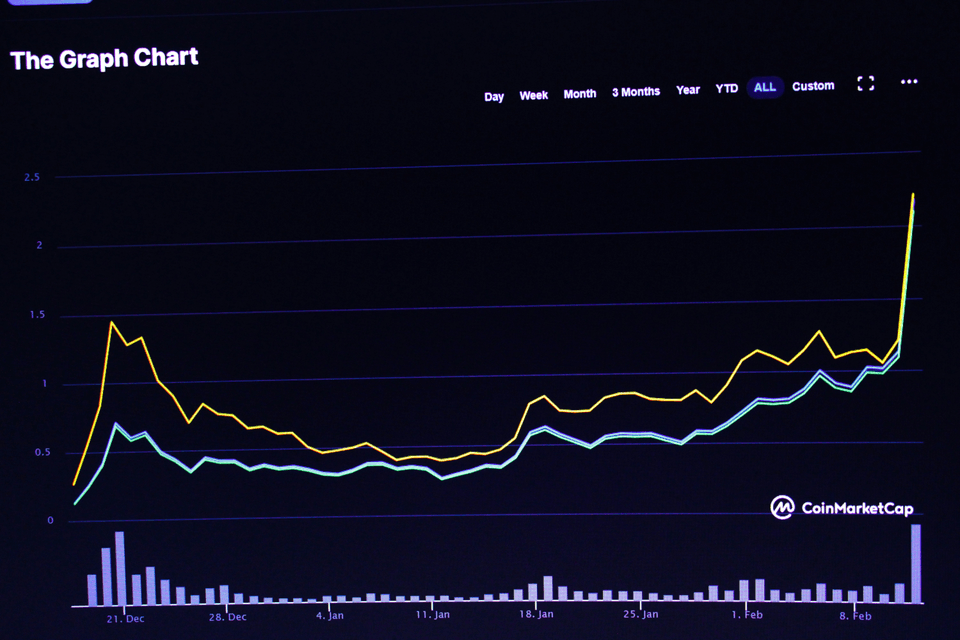

Financial Forecasting

Accurate forecasting is key to effective planning and growth. Our financial forecasting services utilize historical data and market trends to project future revenues and expenses. This enables you to set realistic goals and develop strategies that align with your business objectives.

Risk Management Advisory

Identifying and managing risks is essential for sustaining growth. Our advisory team provides tailored risk management strategies that help mitigate potential threats to your business. We work collaboratively with you to assess risks and implement effective controls for a more secure business environment.Common Queries

Your questions answered for clarity

What types of businesses do you serve?

How can I benefit from your advisory services?

What is the process for preparing financial statements?

Do I need to have my financial statements prepared annually?

What’s the difference between bookkeeping and accounting?

How often should I reconcile my accounts?

Can you help me catch up on overdue accounting records?

Do I need to register for VAT?

How can I reduce my tax liability legally?

What happens if I missed a tax deadline?

Can I claim home office expenses?

Should I register as a sole proprietor or a company?

How can I improve my cash flow?

Can you help me prepare for funding or investment?

Do you offer business growth strategies?